Margin Calculations

Let’s start by using an example trade on an account with a particular balance. In our example let’s say a client wants to open a buy position of 0.50 lots of EURUSD when they have a balance of 5,000 USD and an account leverage of 100:1.

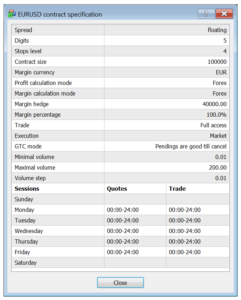

The first question to answer is how much is 0.50 lots of EURUSD. If we refer to the MT4 contract specifications dialog box we can see a contract size of 100,000 and a margin currency of EUR, which means 1.00 lot is 100,000 of EUR (base currency). So, a 0.50 lot position is confirmed to be exposure of 50,000 EUR worth of USD. In this case the trader will want to know how much margin will be required in order to open that position. Assuming the account leverage is 100:1 we just take 50,000 EUR divide it by 100 then convert that EUR amount to the account currency (which is USD). So, if the EURUSD rate is 1.17 and the client wants to open 0.50 lot of EURUSD, 585 USD will be taken for margin. With an account balance of 5,000 that means 4,415 USD will be left to absorb profit/loss.

Pip Value Calculations

Another question a trader will have is how much profit and loss in USD terms will there be for every pip/point of movement. In this case we simply need to make a pip/point calculation, for which there is a simple formula. Once we have that information a client can then set their take profit or stop losses and understand exactly how much they will gain or lose in USD terms if their stops are hit.

A simple formula to calculate pips/point values can be done in 1 or 2 steps:

Step 1.

Pip/point value in quote currency = pip/point in decimal places * notional trade size, then

Step 2.

Convert pip value in quote currency to account currency (only required if account currency is different)

In the above example the quote currency refers to the currency a symbol’s price is quoted in (which is always the latter currency of a currency pair). For example the EURUSD price is quoted in USD.

If we take the example of 0.50 lot of EURUSD and we want to work out the pip value we simply take the notional order size of 50,000 currency units and multiply it by the pip definition of 0.0001 and that gives us a value of 5, which is the value in USD of a pip. Since the quote currency is the same as the account currency in the above example no further calculation is required.

If we take a different example of 0.50 lot of GBPAUD and we want to work out the pip value we take the notional order size of 50,000 currency units and multiply it by the pip definition of 0.0001 and that gives us a value of 5, which is the value in AUD of a pip. Since we want to find out the USD amount we simply multiply that value (5) by the AUDUSD rate and it gives us a pip value of 3.95 USD with an example AUDUSD rate of 0.79000

Swap Calculations

Before getting into a position traders also need to be aware of any swaps or interest that may be charged each night a position is rolled over. This information can also be found in the MT4 Contract Specification dialog windows. With XGLOBAL Lebanon we will use the example of AUDUSD as swaps are charged on that currency pair. In the contract specifications there are 4 fields we need to pay attention to, which are swap type, swap long, swap short and 3-days swap.

Let’s use an example to explain how the daily swap amount is calculated. We will use the example of a sell 0.50 lot AUDUSD position. In this example the swap type is “points”, swap long is “-1.43”, swap short is “-3.09” and the 3 days swap is Wednesday. Since we are selling the swaps that will apply are the swap short of -3.09, which as pointed out has the swaps type defined in points. In addition the 3-days swap is Wednesday. That means every Wednesday night 3x swap rate is charged to compensate for there being no swaps charged over the weekend. This means if you open on Wednesday and close on Thursday you will be charged 3 nights worth of swaps. In order to calculate how much swaps are charged each night we just need to work out the point value and multiply it by the swaps short rate of -3.09. Notice that this is calculated as “points”, which is the last decimal, not “pips” which in the case of AUDUSD is the second from last decimal.

So the calculation is 50,000 * 0.00001 * -3.09 = -1.45 USD in swaps will be deducted each day the position is open, except for Wednesday when 3 times that amount is charged and the Weekend nights when there will be no charge. Again this could be critical information if someone was planning to leave a position open over a long timeframe.

Margin Requirements of Hedged Positions

Quite often traders like to hedge a position if they are over-exposed and the direction of the market is looking like it will go against them. In these cases some traders will hedge their trades and wait until the market gives a clearer indication of the direction it is going in. They will then un-hedge their position to take advantage of the clearer direction they can see the market moving in at that time. Alternatively, some clients simply like to bet against their positions and set appropriate take profits in anticipation that there will be enough volatility in the market to trigger the take profits on both positions.

Whatever the strategy in mind some traders simply like to hedge their positions sometimes. In these cases the broker is not really exposed much as any profit and loss of both positions are exactly offset. The only time a stop-out could occur is if an unprecedented amount of widening happened in the market which would affect the P&L of the trades but the reality is a broker will not likely be affected. It is for this reason that brokers are able to reduce the margin terms when positions are fully or partially hedged.

You can check the hedged margin policy by looking at the “Margin hedge” field in the MT4 contract specifications dialog box for any symbol you are interested in. For Forex pairs this is typically defined in relation to the contract size and with CFDs it may be related to the Margin Initial setting. Either way, most brokers will have the hedged margin set so that no additional margin is used if a client wishes to hedge a position. In fact XGLOBAL Lebanon reduces the amount of margin used if a client hedges their position. This gives traders the flexibility to open new trades while their existing positions are hedged. While this is not important pre-trade information it may be critical to know, depending on your strategy.